US Federal Housing Chair Bill Pulte calls for Congress to INVESTIGATE Jerome Powell

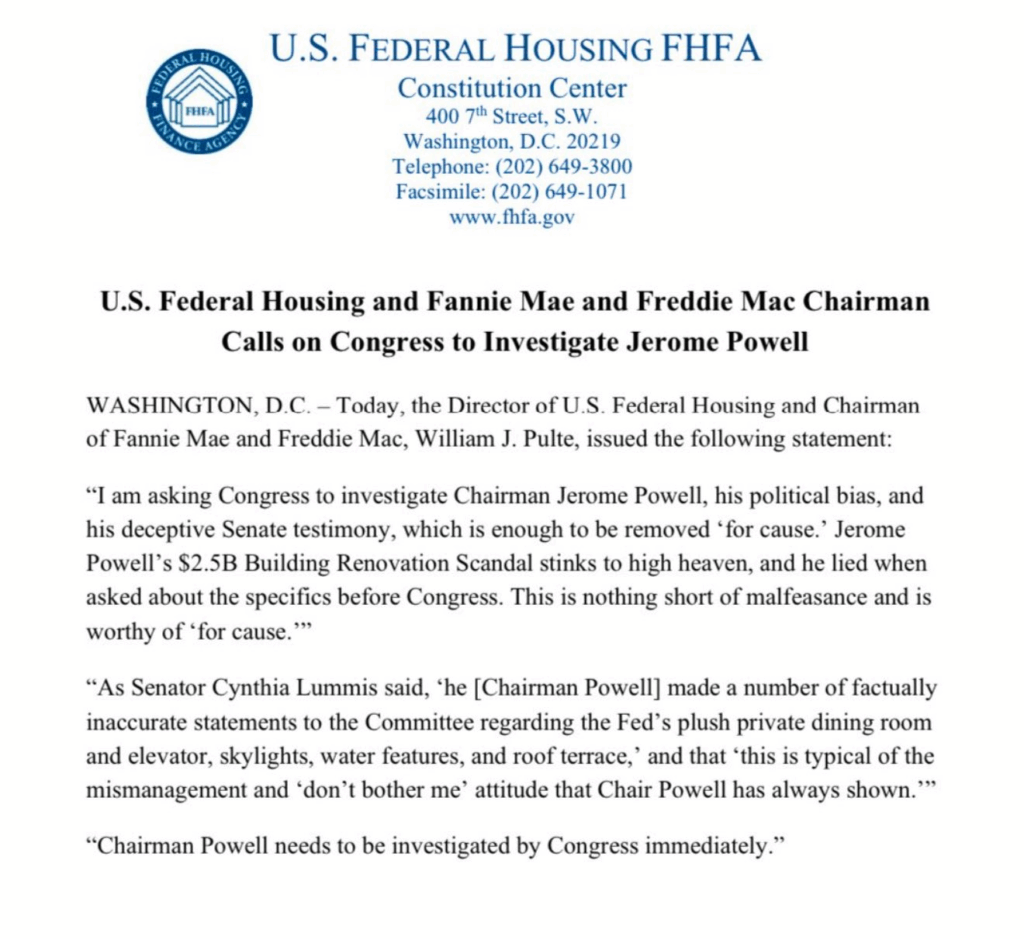

Bill Pulte, Chairman of the U.S. Federal Housing Council, is calling on Congress to launch a formal investigation into Federal Reserve Chairman Jerome Powell over what he described as the deliberate maintenance of artificially high interest rates intended to undermine President Donald J. Trump’s economic agenda.

In a statement posted to social media, Pulte accused Powell of keeping rates elevated beyond what current market conditions warrant, despite declining inflation and widespread economic strain on American homeowners. “It’s time for Congress to investigate Jerome Powell,” Pulte wrote. “He’s causing enormous harm to millions of homeowners and buyers by refusing to adjust interest rates in line with economic reality—all to spite President Trump.”

Mortgage rates have remained near 7 percent, even as core inflation has dropped below 2.5 percent in recent months. The high borrowing costs have significantly slowed home sales and put pressure on first-time buyers, prompting growing criticism from within conservative economic circles. Pulte argues that the Federal Reserve’s inaction is politically motivated and no longer justifiable based on data.

While Powell has not responded directly to Pulte’s allegations, Federal Reserve officials have consistently stated that rate policy decisions are driven by long-term stability goals and not political considerations. In previous public comments, Powell emphasized the need to avoid premature cuts that could reignite inflation.

Chairman Pulte, a vocal supporter of Trump’s housing and economic initiatives, has become increasingly outspoken since his appointment earlier this year. He argues that monetary policy should be responsive to current market needs, not held hostage by what he called “bureaucratic stubbornness.”

The call for a congressional investigation has gained attention from several members of the House Freedom Caucus, with some lawmakers indicating they would support a formal inquiry if rate cuts are not considered at the Fed’s next policy meeting.

As housing affordability remains one of the top issues for American families, the political pressure on Powell and the Fed is expected to intensify, especially with President Trump’s administration seeking to revive homeownership through targeted incentives and lower borrowing costs.